Homeowners Insurance in and around Henderson

If walls could talk, Henderson, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

What's More Important Than A Secure Home?

Your home and property have monetary value. Your home is more than just a structure. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! That’s why the most sensible step is to get excellent homeowners insurance from State Farm.

If walls could talk, Henderson, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

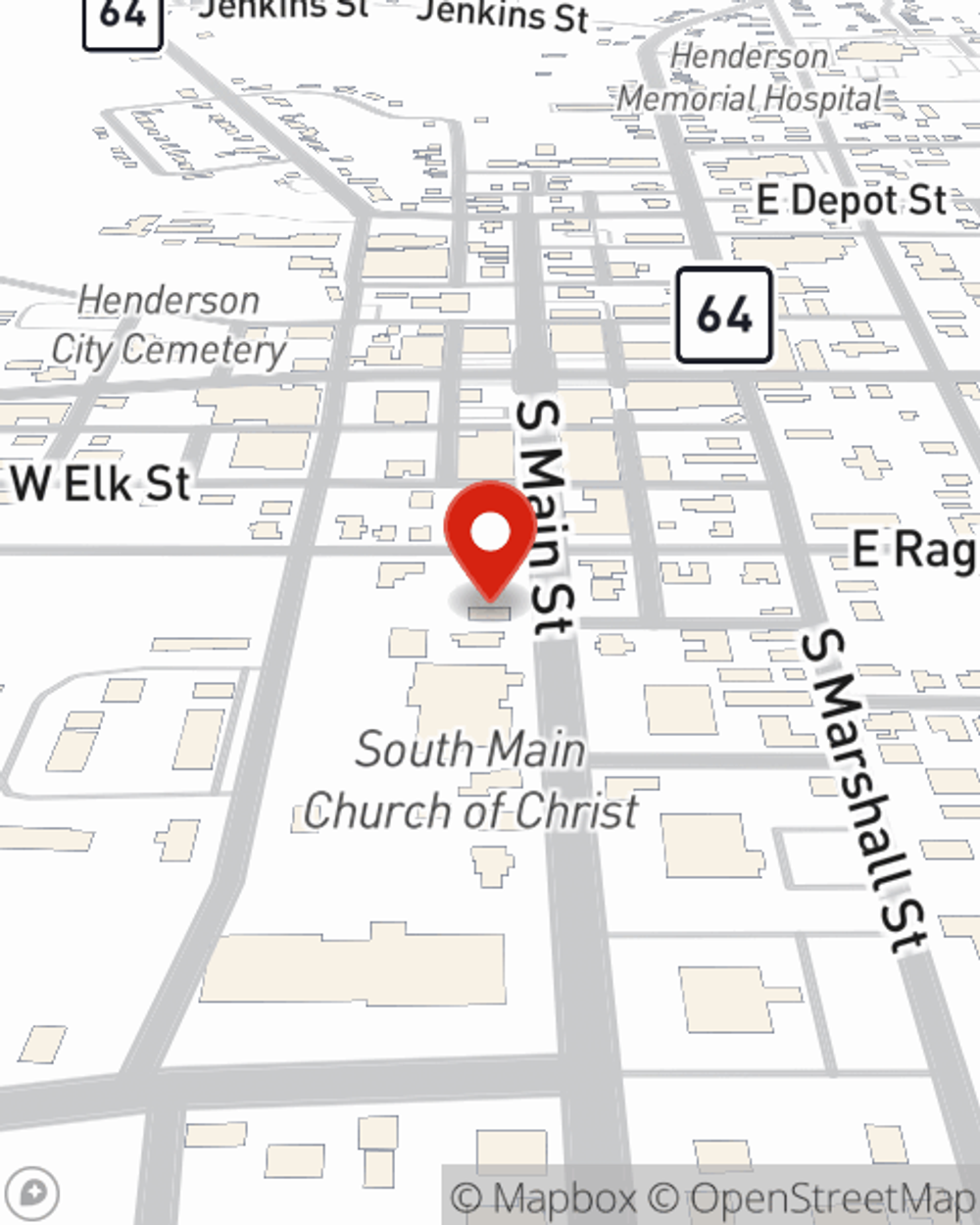

Agent Dave Powell, At Your Service

Agent Dave Powell has got you, your home, and your valuables secured with State Farm's homeowners insurance. You can call or go online today to get a move on developing a policy that fits your needs.

Your home is important, but unfortunately, the unexpected circumstance is not off the table. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Dave Powell can help you put together the right home policy!

Have More Questions About Homeowners Insurance?

Call Dave at (903) 657-4566 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

Dave Powell

State Farm® Insurance AgentSimple Insights®

Make your windows energy efficient

Make your windows energy efficient

Make your windows energy efficient with simple DIY updates, such as installing storm windows and sealing air leaks with caulk or weather stripping.

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.